As has often been reported in QROPS Review, interest in transferring UK pensions overseas has never been stronger.

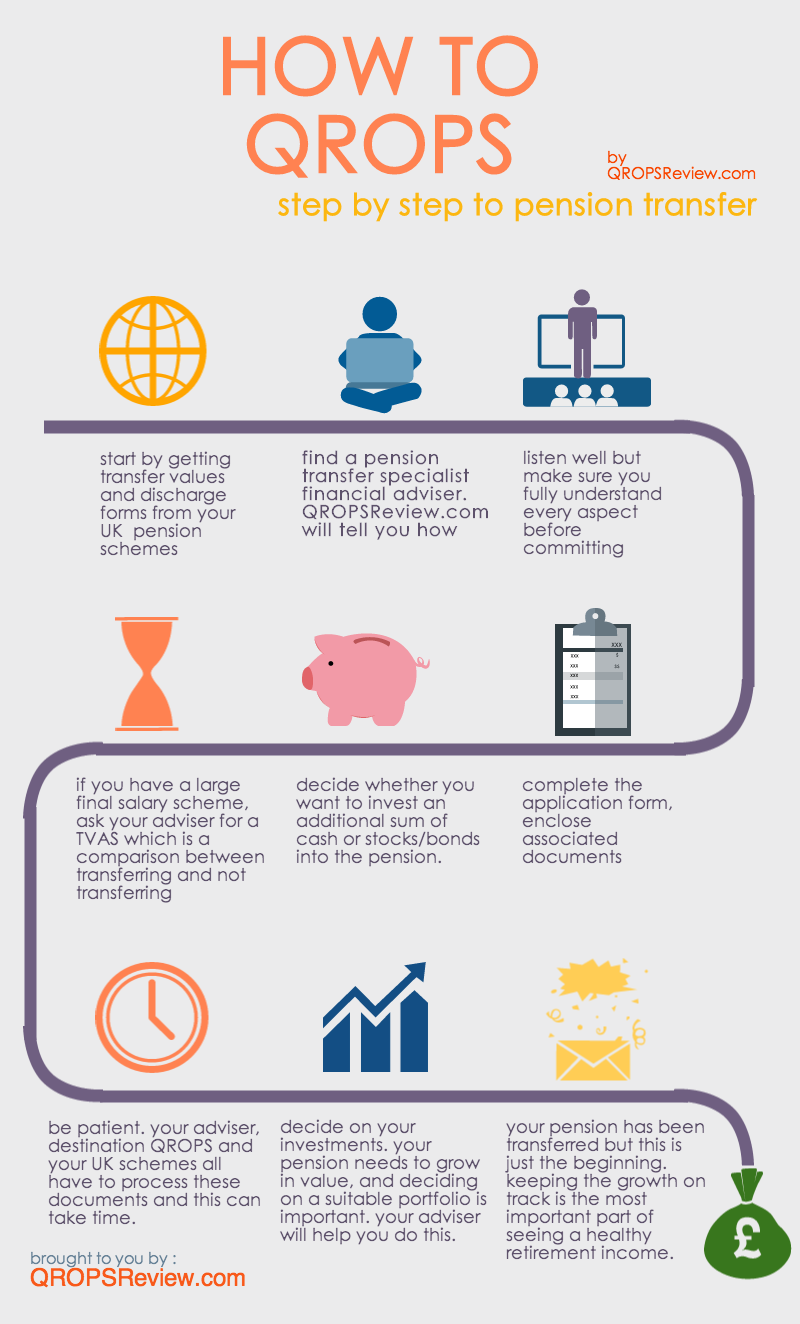

However, despite QROPS becoming a more and more common solution for UK pension holders who are no longer in the UK, there still remains a certain degree of confusion around the process involved.

At QROPS Review, we’ve put together a handy infographic that we hope will explain what is involved in moving a UK pension overseas. Read More

Gibraltar, one of the stalwarts of the global Qualifying Recognised Overseas Pension Scheme (QROPS) industry, has a new trustee offering. Corinthian Pension Trustees has received a license from the jurisdiction’s Financial Services Commission. This means that they will be able to provide trusteeship to pension schemes in Gibraltar.

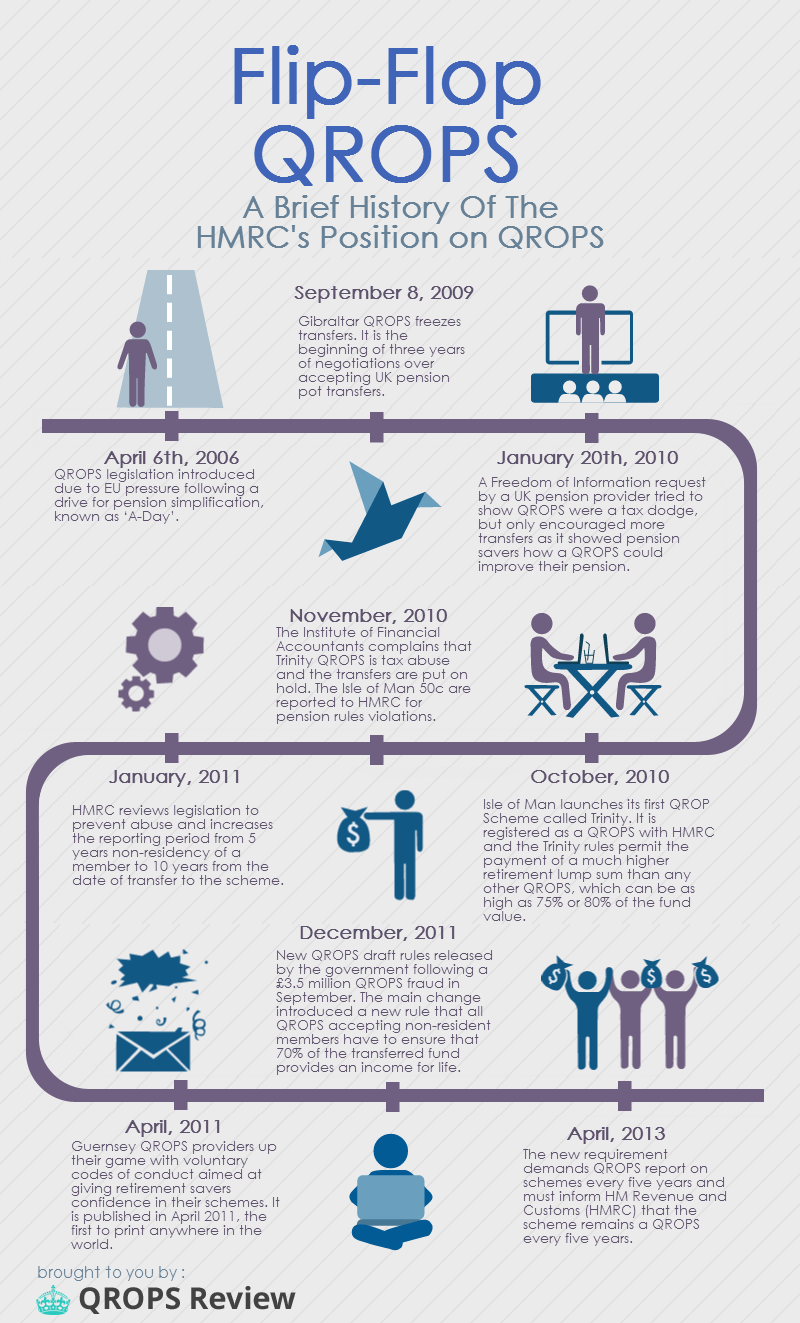

Gibraltar, one of the stalwarts of the global Qualifying Recognised Overseas Pension Scheme (QROPS) industry, has a new trustee offering. Corinthian Pension Trustees has received a license from the jurisdiction’s Financial Services Commission. This means that they will be able to provide trusteeship to pension schemes in Gibraltar. The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride.

The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride. A recent industry report has claimed that a retirement income of £15 000 is necessary to provide a “comfortable” standard of living.

A recent industry report has claimed that a retirement income of £15 000 is necessary to provide a “comfortable” standard of living. Every time the UK Chancellor of the Exchequer rises to his feet to give his now biannual statement to the House of Commons the media clamours over itself to hail some major change or other.

Every time the UK Chancellor of the Exchequer rises to his feet to give his now biannual statement to the House of Commons the media clamours over itself to hail some major change or other. In it’s industry newsletter released today, HMRC made amendments to the two reporting forms used by QROPS scheme administrators to notify HMRC of receipt of a transfer.

In it’s industry newsletter released today, HMRC made amendments to the two reporting forms used by QROPS scheme administrators to notify HMRC of receipt of a transfer.