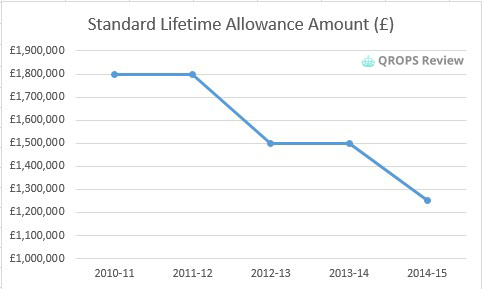

On 6th April 2014 Life Time Allowance (LTA) limits will decrease by £250,000, meaning pension savings that fall above this lowered limit will no longer be tax-free.

This is the third time in four years that the government has lowered the LTA, as can be seen in the graph below.

If your pension pot falls within this bracket, you could become liable to pay a 55% tax rate. If you are an expat who hasn’t already done so, then it’s time to consider transferring your pension to a QROPS. By moving your pension pot offshore before 6th April you can legally avoid taxes of up to 55%.

Industry analysts have already seen a demonstrable increase in QROPS enquiries during this quarter (30%), and we predict this will leap even higher as the deadline approaches.