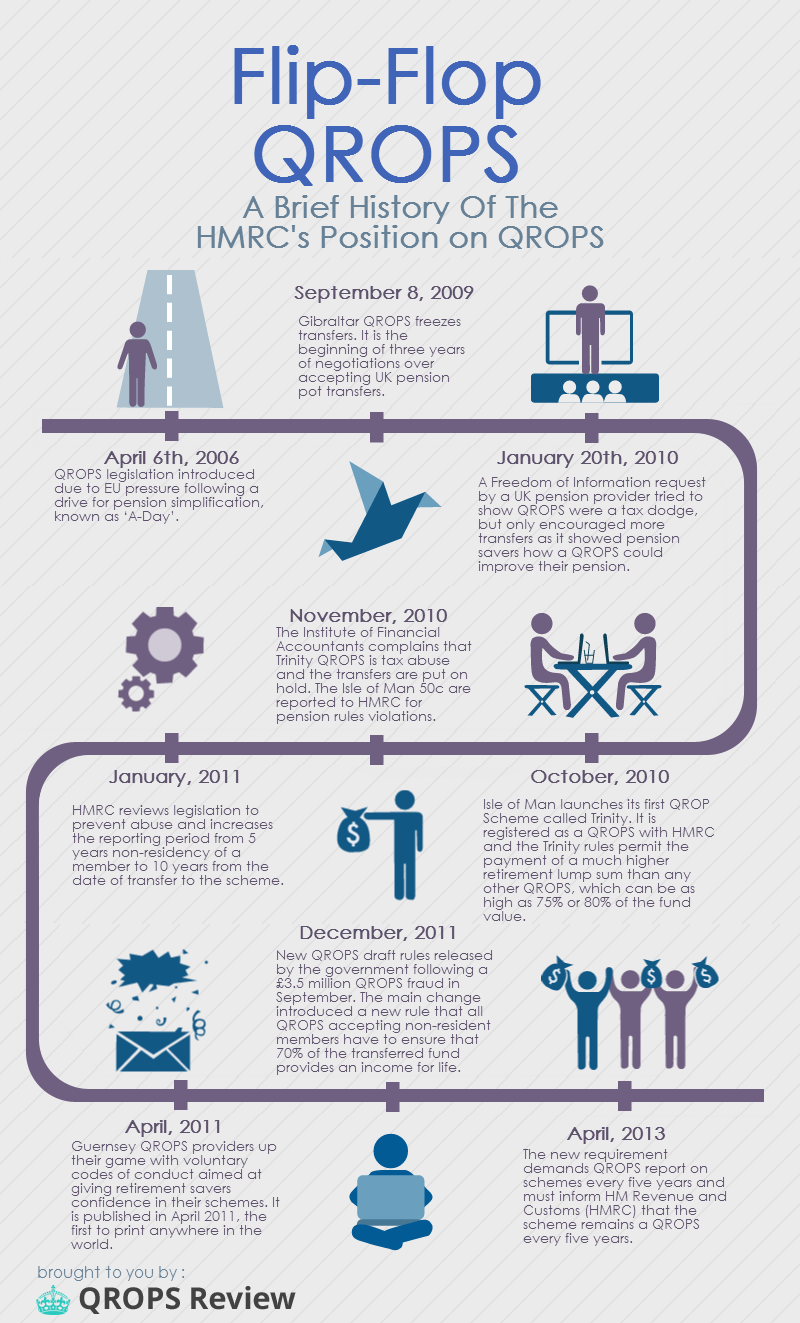

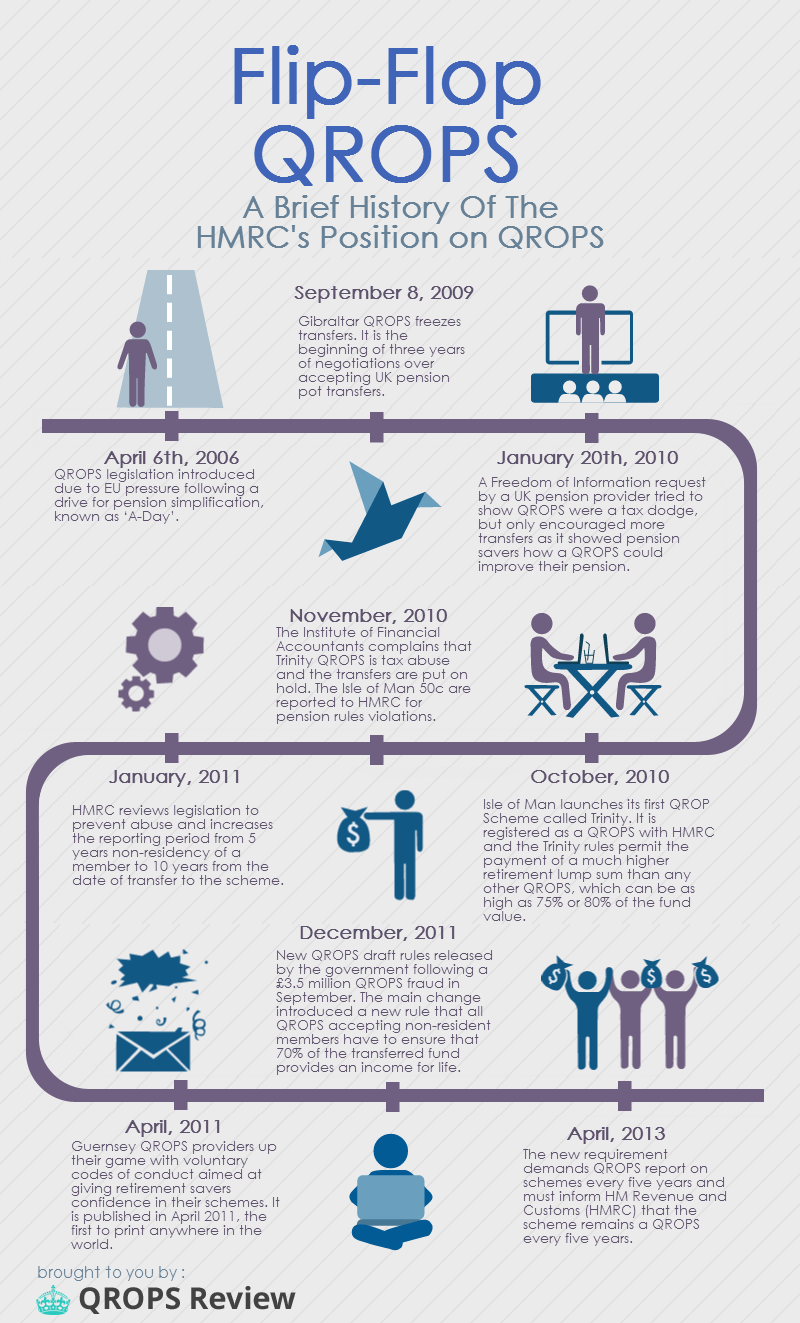

The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride.

The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride.

This is in no small part due to various complications in the way that QROPS has been rolled out across the world’s various tax regimes, legal disputes lodged against the HMRC on behalf of disgruntled pension holders and numerous alterations to the legislation that makes these schemes possible.

Here we take a quick look at the history of QROPS and the key events which have brought us to the current state of affairs. This is by no means an exhaustive list, but it does give a sense of how rapidly QROPS legislation and management have changed over the last 8 years. Read More

Gibraltar, one of the stalwarts of the global Qualifying Recognised Overseas Pension Scheme (QROPS) industry, has a new trustee offering. Corinthian Pension Trustees has received a license from the jurisdiction’s Financial Services Commission. This means that they will be able to provide trusteeship to pension schemes in Gibraltar.

Gibraltar, one of the stalwarts of the global Qualifying Recognised Overseas Pension Scheme (QROPS) industry, has a new trustee offering. Corinthian Pension Trustees has received a license from the jurisdiction’s Financial Services Commission. This means that they will be able to provide trusteeship to pension schemes in Gibraltar.

The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride.

The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride.