As has often been reported in QROPS Review, interest in transferring UK pensions overseas has never been stronger.

However, despite QROPS becoming a more and more common solution for UK pension holders who are no longer in the UK, there still remains a certain degree of confusion around the process involved.

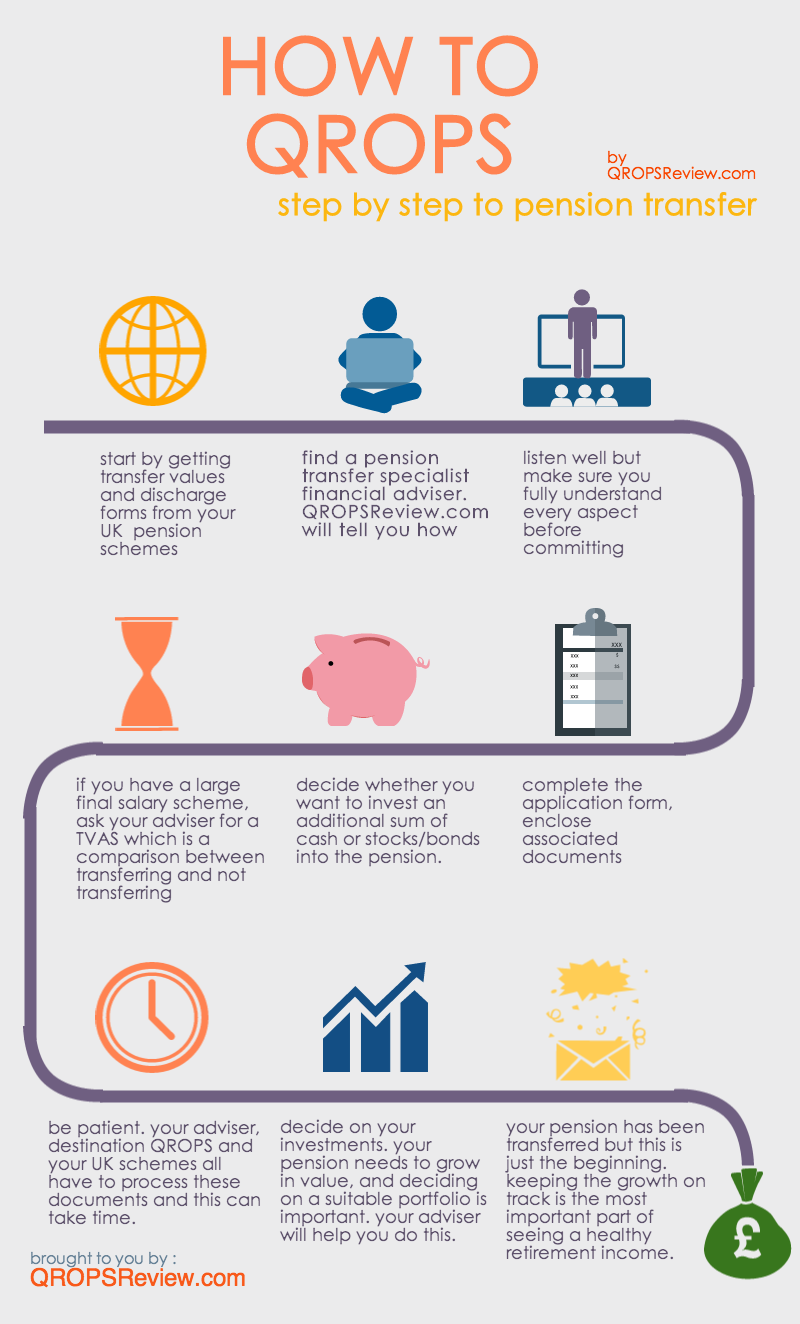

At QROPS Review, we’ve put together a handy infographic that we hope will explain what is involved in moving a UK pension overseas.

The entire exercise can take several weeks to complete and it will be necessary to obtain specialist financial advice from a pension transfer expert. A QROPS will not be suitable for every circumstance and, because each individual will have a particular set of requirements, it is important that an expert is consulted.

An experienced IFA will be able to tailor a solution to your personal circumstances and QROPS Review can help you find a suitable option.

You will start by getting transfer values and discharge paperwork from your existing pension schemes. Your chosen financial adviser will work with you to identify your aims and objectives and will put together a bespoke recommendation.

After that, if your pension is a large final salary scheme, your adviser may suggest that you obtain a TVAS which will compare the benefits of transferring with the benefits of leaving the scheme as it is.

At this point you will have to compete the relevant forms for the destination scheme and include any relevant documentation. The wait for these documents to be processed by the various schemes can take some time so you will have to exercise some patience!

Where a good adviser will differentiate themselves from a great adviser is in the determination of a fund choice. This is what will gie you the growth that will deliver the income that you need in retirement.