Huge update to HMRC QROPS List Sees Deletion of 118 Schemes

Posted by Matthew Carp | Offshore, Pensions | No Comments The HMRC list of Qualifying Recognised Overseas Pension Schemes (QROPS) was updated on 15th July with a record number of QROPS having been deleted.

The HMRC list of Qualifying Recognised Overseas Pension Schemes (QROPS) was updated on 15th July with a record number of QROPS having been deleted.

HMRC’s list represents all overseas pension schemes that have told the UK authorities that they meet the conditions necessary to be a QROPS.

QROPSreview.com has previously reported on HMRC’s list and explained how it should be treated with some caution and should never be used as a guide as to which QROPS would be a good destination for a pension transfer.

The most recent changes have seen a total of 118 schemes removed from the list. Read More

QROPSreview.com has previously reported on the new pension rules proposed by George Osborne in his March 2014 Budget Statement. Much of the media was left scrambling to detail this so called hammerblow to the status quo. Many column inches were filled celebrating the end of the annuity.

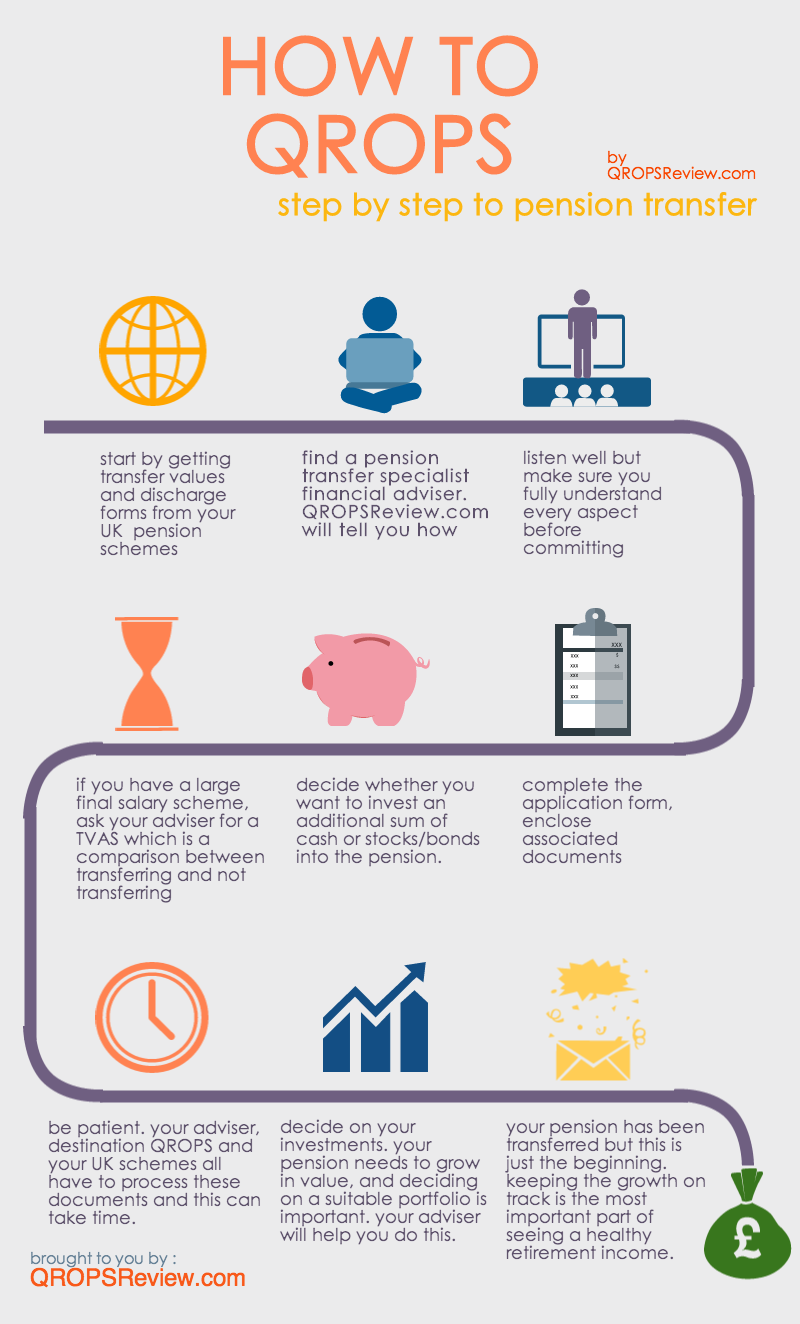

QROPSreview.com has previously reported on the new pension rules proposed by George Osborne in his March 2014 Budget Statement. Much of the media was left scrambling to detail this so called hammerblow to the status quo. Many column inches were filled celebrating the end of the annuity. Pensions transfers for people who are thinking about leaving or have already left the UK are often advised – they can carry huge benefits in terms of tax advantages, relaxed rules, leaving your pension to your heirs and more. However, because the QROPS are all outside of the UK, it can be a murky and confusing world.

Pensions transfers for people who are thinking about leaving or have already left the UK are often advised – they can carry huge benefits in terms of tax advantages, relaxed rules, leaving your pension to your heirs and more. However, because the QROPS are all outside of the UK, it can be a murky and confusing world. Over the last 30 years, the London property market has garnered near mythical status among investors. In spite of the worst economic slowdown for at least 70 years, house prices in the South East have proven surprisingly resilient.

Over the last 30 years, the London property market has garnered near mythical status among investors. In spite of the worst economic slowdown for at least 70 years, house prices in the South East have proven surprisingly resilient. Most people have a defined contribution (also known as money purchase) pension scheme where the saver will contribute to a pot of money that will be used to provide an income in retirement. However, there are other schemes which can be referred to as defined benefit or final salary schemes.

Most people have a defined contribution (also known as money purchase) pension scheme where the saver will contribute to a pot of money that will be used to provide an income in retirement. However, there are other schemes which can be referred to as defined benefit or final salary schemes. New research from insurance giant Prudential reveals that British expat pensioners living in the Eurozone have seen a large rise in the buying power of their UK state pension. This is due to an improved pound to euro exchange rate.

New research from insurance giant Prudential reveals that British expat pensioners living in the Eurozone have seen a large rise in the buying power of their UK state pension. This is due to an improved pound to euro exchange rate.