Pensions transfers for people who are thinking about leaving or have already left the UK are often advised – they can carry huge benefits in terms of tax advantages, relaxed rules, leaving your pension to your heirs and more. However, because the QROPS are all outside of the UK, it can be a murky and confusing world.

Pensions transfers for people who are thinking about leaving or have already left the UK are often advised – they can carry huge benefits in terms of tax advantages, relaxed rules, leaving your pension to your heirs and more. However, because the QROPS are all outside of the UK, it can be a murky and confusing world.

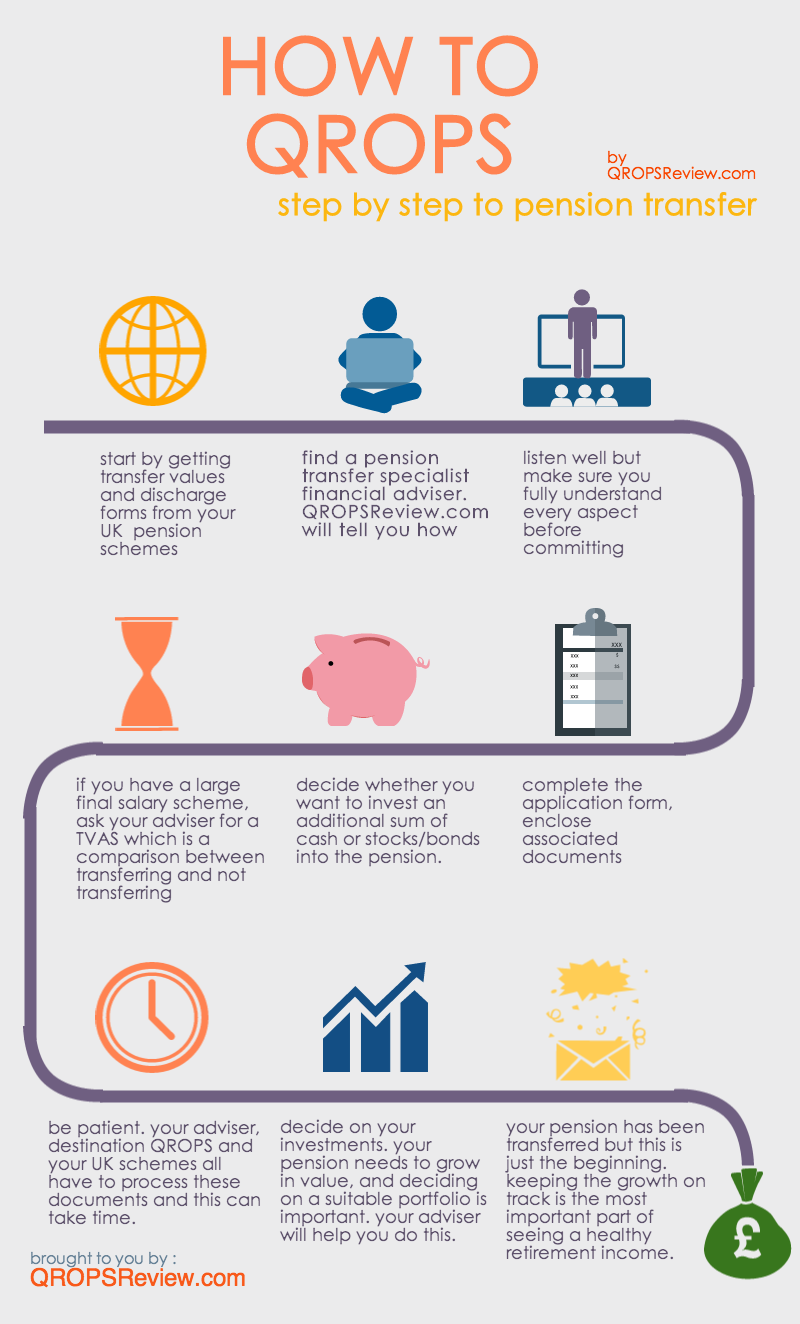

One of the first steps that most people take is to go online and do some preliminary research on the internet. This can be a mistake. Much of the information found online was once correct, but has been superseded by more recent legislation, but has been left online. This, combined with more recent articles can only serve to confuse.

One prominent IFA company we spoke to says that a lot of his clients approach the QROPS list on the HMRC website and attempt to contact random QROPS on the list. This can have some amusing consequences. Read More

Most people have a defined contribution (also known as money purchase) pension scheme where the saver will contribute to a pot of money that will be used to provide an income in retirement. However, there are other schemes which can be referred to as defined benefit or final salary schemes.

Most people have a defined contribution (also known as money purchase) pension scheme where the saver will contribute to a pot of money that will be used to provide an income in retirement. However, there are other schemes which can be referred to as defined benefit or final salary schemes. New research from insurance giant Prudential reveals that British expat pensioners living in the Eurozone have seen a large rise in the buying power of their UK state pension. This is due to an improved pound to euro exchange rate.

New research from insurance giant Prudential reveals that British expat pensioners living in the Eurozone have seen a large rise in the buying power of their UK state pension. This is due to an improved pound to euro exchange rate.

Gibraltar, one of the stalwarts of the global Qualifying Recognised Overseas Pension Scheme (QROPS) industry, has a new trustee offering. Corinthian Pension Trustees has received a license from the jurisdiction’s Financial Services Commission. This means that they will be able to provide trusteeship to pension schemes in Gibraltar.

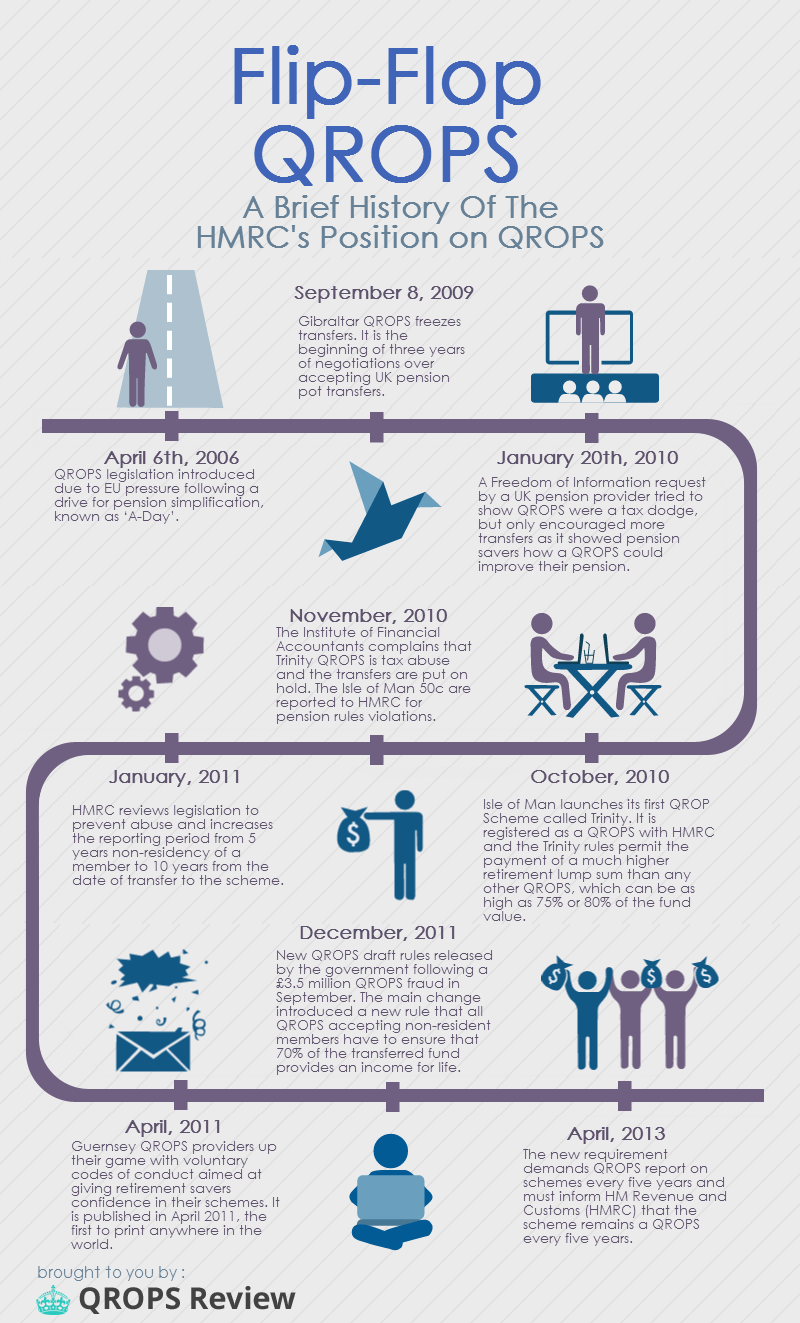

Gibraltar, one of the stalwarts of the global Qualifying Recognised Overseas Pension Scheme (QROPS) industry, has a new trustee offering. Corinthian Pension Trustees has received a license from the jurisdiction’s Financial Services Commission. This means that they will be able to provide trusteeship to pension schemes in Gibraltar. The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride.

The HMRC’s QROPS rules have helped many people get tax efficient access to their UK pension pots since it was introduced in 2006, but it hasn’t exactly been an easy ride. A recent industry report has claimed that a retirement income of £15 000 is necessary to provide a “comfortable” standard of living.

A recent industry report has claimed that a retirement income of £15 000 is necessary to provide a “comfortable” standard of living.

Every time the UK Chancellor of the Exchequer rises to his feet to give his now biannual statement to the House of Commons the media clamours over itself to hail some major change or other.

Every time the UK Chancellor of the Exchequer rises to his feet to give his now biannual statement to the House of Commons the media clamours over itself to hail some major change or other. Promising signs of economic recovery aside, it’s fair to say that the majority of the UK population is still mired in financial anxiety. Young people struggle to get on the property ladder due to the extortionate entry price (particularly in the capital), soaring energy prices leave the poorest and most vulnerable cold, and

Promising signs of economic recovery aside, it’s fair to say that the majority of the UK population is still mired in financial anxiety. Young people struggle to get on the property ladder due to the extortionate entry price (particularly in the capital), soaring energy prices leave the poorest and most vulnerable cold, and